Links to official online payment portals for VA, MD, DC,

and Federal taxes.

You will need to verify your identity by entering or confirming information from a return filed within the last 6 years. You can choose which one to use for verification. It is recommended that you have a copy of the return you plan to use to verify your identity readily available when you begin the payment process.

For Tax Returns with Balances Due, For Extensions, For Estimated Tax Payments

Click Bank Account (direct pay) OR Debit Card or Credit Card – there is a fee for using a card. Instructions below are for the Bank Account option, but the Card option is similar

Click Make A Payment

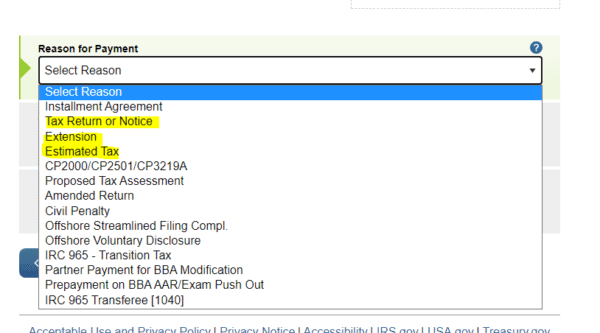

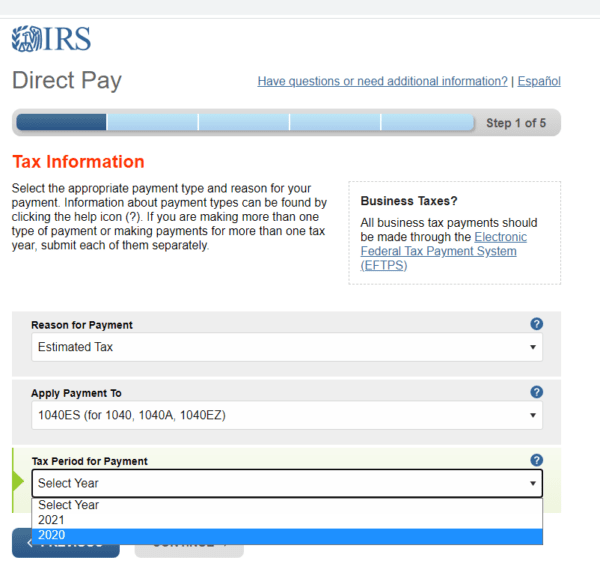

Select the following:

Reason: Choose the appropriate reason – Most common are listed below

Tax Return or Notice – For Balance Due for Tax Return or Notice

Extension – Extension Payment for Tax Return

Estimated Tax – 1040ES (for 1040, 1040A, 1040EZ) – Defaults when Estimated Tax is Selected

Apply Payment to:

Tax Return or Notice – 1040, 1040A, 1040EZ

Extension – 4868 (for 1040, 1040A, 1040EZ) Defaults when Extension is Selected

Estimated Tax – 1040ES (for 1040, 1040A, 1040EZ) – Defaults when Estimated Tax is Selected

Tax Period:

Tax Return or Notice – Choose Correct Year

Extension – Defaults to the Appropriate Year

Estimated Tax – Choose Appropriate Tax Year – Defaults to the eligible years for estimated payments

Click Continue

Verify your Identity – Answer the questions based on filed tax returns, can be any tax return filed in the last six years

Click Continue and follow remaining instructions.

https://www.tax.virginia.gov/individual-income-tax-payment-options

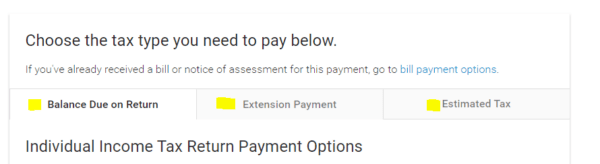

You may visit the main payment page for Virginia Individual Tax Payments or follow the specific links below for the type of payment you need to make.

If you visit the main Virginia Department of Taxation page, be sure to select the tab of the type of payment you would like to make.

It is not required to create an account. Use the eForms option on the appropriate page to pay with direct debit or select the Paymentus link to pay with credit or debit card (additional fee) for balance due and estimated tax payments.

DIRECT LINKS

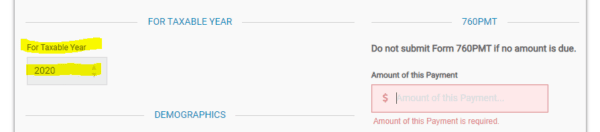

For all payments via eForms, Be sure to choose the correct year for your payment.

Balance Due on Return:

Direct Debit - please have bank account and routing numbers available https://www.business.tax.virginia.gov/tax_eforms/760PMT-eForm.html

Be sure to choose the correct year for your payment.

Credit or Debit Card (additional fee) - Make a return payment (choose "Individual Tax Return Payments") through Paymentus. A service fee is added to each payment you make with your card.

https://ipn2.paymentus.com/rotp/vatx

Extension Payment:

Direct Debit Only for extension payments - please have bank account and routing numbers available

https://www.business.tax.virginia.gov/tax_eforms/760IP-eForm.html

Estimated Tax Payments

Direct Debit - please have bank account and routing numbers available

https://www.business.tax.virginia.gov/tax_eforms/760ES-eForm.html

Credit or Debit Card (additional fee) - Pay using a credit or debit card through Paymentus (choose "Individual Estimated Tax Payments"). A service fee is added to each payment you make with your card.

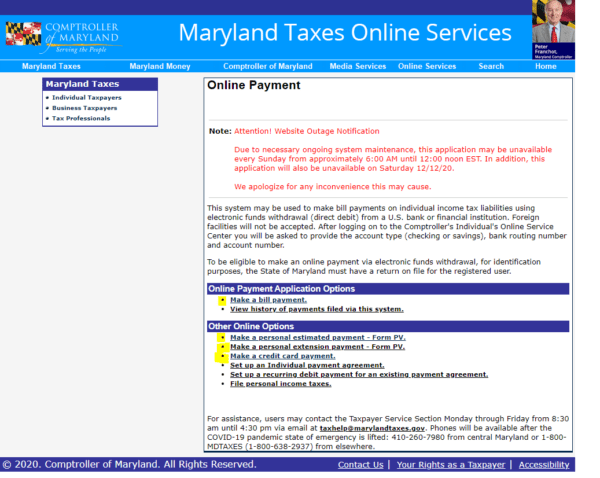

Online Bill Pay: https://interactive.marylandtaxes.gov/Individuals/Payment/

Credit Card: https://www.marylandtaxes.gov/business/tax-assistance/credit-card.php

Taxpayers will be required to create an account to use Online Bill Pay. Taxpayers will need to enter information from their prior year filed return in order to have immediate access.

This page also has a link to a credit card payment option which allows for payments without account creation. Be sure to choose the correct Tax Type and Year. There is a fee associated with credit card payments.

https://otr.cfo.dc.gov/service/payment-options-individual-income-tax

DC’s Office of Tax and Revenue will receive the electronic transaction from the vendor and apply it to the taxpayer's account. The District's third-party payment vendor will charge taxpayers a nominal fee for the credit/debit card transaction based on 2.5 percent of the transaction amount.

Quick Payment Option - Individuals only, not for business payments

www.MyTax.DC.gov - Click on the Pay with Credit/Debit Card link under Quick Payments near the middle of the page, on the right that looks like this:

To pay by electronic check without additional fees you must have a www.MyTax.DC.gov account.

ACH Debit (Electronic Check)

To remit payment, please log in to your MyTax.DC.gov account, which allows you to pay directly from your bank account without any fees.

Credit/Debit Card

To remit payment, please log in to your MyTax.DC.gov account or use the Quick Payment option above. You will be charged a fee that is paid directly to the District's credit card service provider. Payment is effective on the day it is charged.