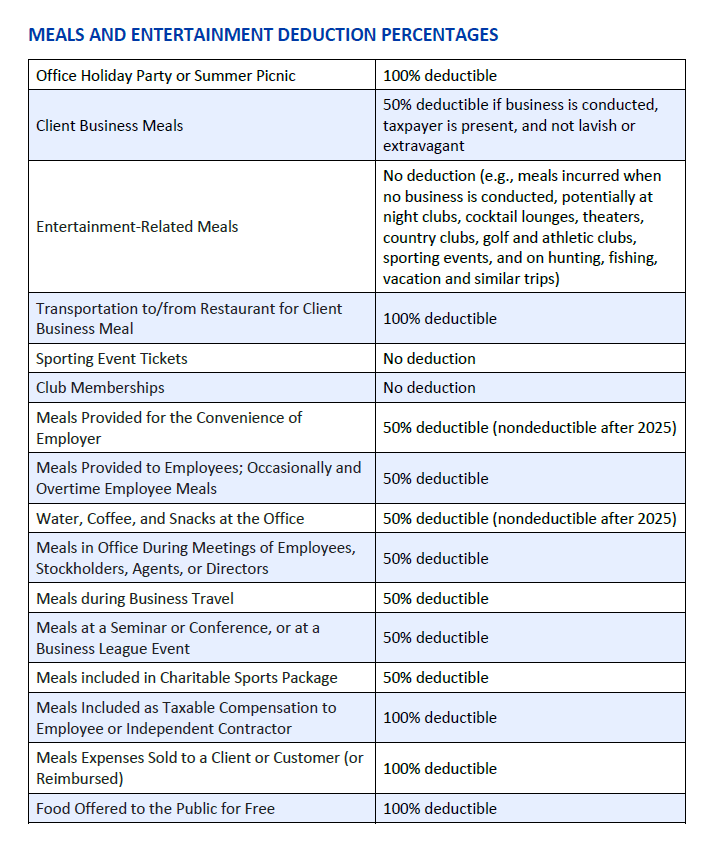

Since the passing of the Tax Cuts and Jobs Act at the end of 2017, there has been confusion surrounding what exactly can be deducted as a business expense as it relates to meals and entertainment.

Entertainment on its own is no longer a deductible expense, however there are some occasions where meals are deductible and in some cases vary between 50% and 100% deductibility.

Click here for a downloadable copy of this information.

We are here to help you. Please contact us if you wish to discuss these or other tax matters further.