If someone asked you ten years ago if you had heard of cryptocurrency, what would your answer have been? If asked about Bitcoin or a “soft fork,” would your mind have gone to an unfortunate penny that went through the garbage disposal? How about a particularly flimsy piece of cutlery? Or would you have been one of the early adopters in this particularly unique space and have been able to spout off a college essay on the subject?

Fast forward a few years and cryptocurrency has gone from an obscure financial asset with a few die-hard supporters to a global phenomenon capturing the world’s attention with eye-popping headlines.

As cryptocurrency has gained popularity, it has also captured the attention of another powerful entity: the U.S. Government. Understandably, when a new financial asset comes to the forefront of everyday conversation, Congress and the IRS are going to figure out how to tax it.

We have put together a three-part series to help guide you through the tax implications of cryptocurrency. Each article in this series will cover one of the following topics:

- Part I: Cryptocurrency reporting requirements

- Part II: Taxation of cryptocurrency

- Part III: Maintaining cryptocurrency records

There is one caveat – new rules and regulations are being proposed and written all the time (especially concerning this field), so what is true today may be revised next week. If you involve yourself in this industry, we highly recommend that you stay current on regulations to keep compliant.

With that said, let’s dive into Part I of this series: Cryptocurrency Reporting Requirements.

A Brief History of the US Government and Cryptocurrency

2014

Despite Bitcoin (commonly considered the first cryptocurrency) being around since 2009, the IRS made its first major foray into cryptocurrency territory five years later in 2014 when it declared that virtual currencies were considered to be property rather than money, regardless of whether a taxpayer uses their cryptocurrency for monetary transactions or as an investment.

Why is this important? When you go to the store and use cash or credit to purchase a new grill, you are not engaging in an income tax-incurring transaction. You are exchanging money for a product. Prior to this notice, many people considered their cryptocurrency to also be a type of money and assumed that exchanging Ethereum or Bitcoin for that grill was also a transaction not subject to income tax.

The IRS classifying cryptocurrency as property is significant because if you exchanged Ethereum for a new grill, it would be similar to if you took your armchair to the store and exchanged it for the product (a transaction that is potentially subject to income tax). We will go into further depth of the tax ramifications of this type of exchange in Part II of this series.

2019

Despite its initial notice, the IRS suspected that many people were not reporting their taxable cryptocurrency transactions. So in 2019, the IRS once again stepped in and sent out 10,000 letters to people they suspected of owning cryptocurrency and who potentially had not reported their taxable transactions. These notices ranged in scariness from letters demanding an explanation why the taxpayer did not report their cryptocurrency transactions to letters detailing a simple warning from the IRS about cryptocurrency accounts.

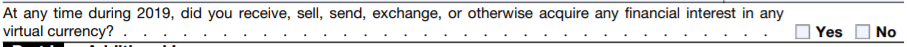

Then, on the 2019 individual tax return, the IRS included a new question:

This question, which was also on the 2020 tax return and will be on the 2021 tax return (with some minor tweaks), forces you to declare, in no uncertain terms, whether you and/or your spouse might have performed a virtual currency transaction during the year.

Before going further, we must ask the question: What is virtual currency? According to the IRS, virtual currency is a digital representation of value that functions as a medium of exchange. Basically, if you have a digital asset that you can use instead of cash or credit in exchange for goods or services, you own virtual currency. Cryptocurrency is one of the easiest financial assets to classify as virtual currency.

The IRS does not currently require you to report whether you have a cryptocurrency balance. If you simply hold your cryptocurrency throughout the entire year in your wallet or exchange account and do not have any further transactions in cryptocurrency, you can answer “No” to this question.

If your answer is “Yes,” it does not necessarily mean that you will be subject to income tax (some virtual currency transactions are nontaxable; see Part II of this series). However, at the very least, it will inform the IRS that you are involved in the industry and that you may have taxable transactions in the future.

There is one more thing to note: you should have a conversation with your college-aged children and other dependents that you claim whether they have opened a cryptocurrency account. In some cases, if your dependent has had virtual currency transactions, they will be required to file their own personal tax return to report any taxable dealings.

2021

Most recently, Congress stepped in to start regulating cryptocurrency. Section 80603 of the new infrastructure bill passed on November 5th has language addressing some key issues regarding cryptocurrency.

First, this bill requires a business or exchange to report to the IRS anytime it receives more than $10,000 in a single transaction. They will be required to report on a Form 8300 the sender’s name, address, social security number or EIN, and other information.

As such, if you decide to purchase a car or transfer $10,000 worth of Bitcoin from your wallet to an exchange, keep in mind that the auto dealership or exchange is going to report that transaction to the government. The IRS is then going to be looking for that sale of cryptocurrency on your tax return. Part II goes into more detail about the taxable ramifications of these two types of transactions.

Another element that Section 80603 of the bill addresses is how the government views some cryptocurrency transactions. As mentioned above, prior to the infrastructure bill, cryptocurrency was always treated as property by the government. Now cryptocurrency is to be treated as securities (such as stocks) when it pertains to capital gains treatment. This is significant because capital gains transactions now fall under the regulation of the Securities and Exchange Commission (SEC). We will address some of the potential ramifications of this in Part II of this series.

There is one more crucial reporting requirement brought up in the bill that we should address. Digital currency “Brokers” will be required to issue form 1099-B to their customers for all virtual currency sales starting after December 31, 2022. This regulation gives cryptocurrency brokers similar reporting requirements as traditional securities brokers. The bill defines a broker as “any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.”

The obvious type of facilitator who falls under this definition is a cryptocurrency exchange. However, many within the industry are concerned that the definition of broker as it stands is too broad. They worry that it may include miners, developers, stakers, and others who may not have the required customer information available to comply with these reporting requirements. Some within the government have advocated for changes to the current language and have sought to remove the reporting requirements from some of these individuals, so this may change in the future.

There are a lot of issues that still need to be ironed out for a 1099-B to be an effective government form in reporting cryptocurrency sales. For example, if you transfer your cryptocurrency from broker to broker, the sending broker will be required to issue a statement to the receiving broker detailing the history of that cryptocurrency including its basis and holding period. This will most likely result in a correct 1099-B at year end.

However, if you send cryptocurrency from a noncustodial wallet or other non-broker to an exchange or other type of broker, the broker most likely will not have some vital information for the transferred cryptocurrency. Then, when you ultimately sell that cryptocurrency, the exchange will probably issue a 1099-B showing an incorrect purchase date and basis. Part III goes into the importance of recordkeeping and basis tracking, which is imperative for any cryptocurrency owner, but especially for those in this situation.

Despite the issues that this reporting requirement brings up, it should help many cryptocurrency owners in their compliance obligations.

Potential Future Reporting Requirements

In addition to laws that have already been passed and notices that have previously been issued, there have been rumblings of additional policies being considered by various agencies of the Federal government concerning cryptocurrency.

For example, in December of 2020, the Financial Crimes Enforcement Network (FinCEN) issued a notice stating that they are considering proposing amendments to current law to require cryptocurrency balances to be reported on an annual FBAR report.

If this occurs, then if you have a cryptocurrency account that exceeds $10,000 at any point during the year, you will be required to file an additional form to FinCEN with information including the financial institution holding your cryptocurrency along with the highest value in that account during the year.

Failing to file an FBAR, even if you never knew one is required, is no joke. You can be hit with some of the highest penalties imposed by the U.S. Government. Keep in mind that if you hold your cryptocurrency in a foreign account, you may currently be required to report it on an FBAR just like any other foreign asset.

State Taxation of Cryptocurrency

One thing that will not be covered in this series is how states view and tax cryptocurrency transactions. As of the writing of this article, few states have even addressed this topic. It is recommended that, if you engage in cryptocurrency transactions, you look up state virtual currency laws in the state in which you reside. If you have cryptocurrency transactions outside of your home state, you should also be aware of the laws in those states as well.

In Summary

The most important detail you should take away from Part I of this cryptocurrency series is that every taxpayer filing a tax return must report on cryptocurrency transactions. Many will simply be required to check the “No” response to the question asking whether they have been involved in virtual currency during the year.

Failure to report cryptocurrency transactions may result in an unwanted notice from the government along with additional taxes and penalties that you did not anticipate. What taxes will you be subject to and how much will you be required to pay? Part II of this series goes into much greater detail about taxable vs. nontaxable cryptocurrency transactions. It will also cover what type of tax these transactions are subject to. Part III will then go into the importance of maintaining records to decrease your annual tax bill.

If you have any questions regarding cryptocurrency reporting requirements, please contact us and we will be happy to assist you.

Written by: Ben Noel, CPA – Senior