With the issuance of Rev Proc 2022-38, the Internal Revenue Service has released the inflation-adjusted tax brackets for 2023. 2022 saw extended periods of inflation, much more than 2021, and consequently, tax brackets were increased accordingly. As a result, this will change the tax due for any given taxpayer. Also, if a taxpayer’s income has stagnated compared to inflation, they will have a smaller tax liability in 2023.

Tax Rate Tables

The table below summarizes the income tax brackets over the last few years and illustrates how the inflation adjustments for 2023 are higher than usual. For example, in the highest tax rate bracket of 37%, the 2021 taxable income threshold of $523,601 for Singles increased to $539,901 for 2022 (an increase of $16,300, a 3.11% increase); and then increased to $578,126 for 2023 (an increase of $38,225, a 7.08% increase). In this example, the 2023 inflation adjustments for the Tax Rate Tables have more than doubled from the 2022 inflation adjustments.

The standard deduction for 2023 has increased to account for inflation as well. This means that a larger standard deduction will shelter more income from federal income tax in 2023 than it did in 2022. The standard deduction in 2023 will increase to $13,850 for single taxpayers, $27,700 for married couples filing jointly and $20,800 for heads of households. This is up from the 2022 amounts of $12,950 for single taxpayers, $25,900 for married couples filing jointly and $19,400 for heads of household.

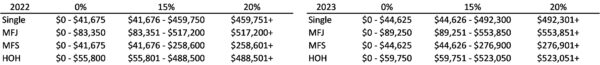

Capital Gains Tax Rate Tables

The IRS also used Rev Proc 2022-38 to announce changes to the capital gains tax brackets. Capital gain taxes are divided into two groups, and the tax that is paid will depend upon how long the asset has been held. Short-term capital gains tax applies to assets held less than a year, and the tax rate used is the same rate paid on your ordinary income (i.e., your wages). Long-term capital gains tax applies to assets held more than a year, and the tax rate used will be 0%, 15% or 20% depending upon your taxable income.

Income Example

If your income has not kept pace with inflation, a higher standard deduction coupled with the inflation adjusted Tax Rate Tables will result in a lower tax liability in 2023, as more of your taxable income will be shielded from taxation than in 2022. For example, a single taxpayer with an AGI of $60,000 of wage compensation would have a tax liability of $6,188 in 2021, $5,968 in 2022 and $5,461 in 2023.

Regarding the capital gains tax, if a single taxpayer had $500,000 in ordinary income and $15,000 in long-term capital gains their long-term capital gains would be taxed at 20% resulting in a long-term gains tax of $3,000 in addition to the tax due on the taxpayer’s ordinary income.

With the inflation adjusted Tax Rate Tables, Standard Deduction and Long-Term Capital Gain Brackets under Rev Proc 2022-38, many filers will find that their tax situation has changed in 2023, regardless of any changes to their income. Please contact your tax advisor if you have any questions on how the issuance of the new tax brackets will affect you.

Written by Ethan Swain – Tax Staff