When it comes to adopting new provisions in the One Big Beautiful Bill Act (OBBBA) for the construction industry, one of the most important amendments is the exception to using the Percentage-of-Completion Method (PCM) for residential construction contracts. This new provision under IRC §460(e) now allows for construction contracts meeting the “residential” definition (such as apartment building contracts) to use the Completed Contract Method (CCM) for recognizing revenue. The tax implications of this change are substantial, allowing more developers and contractors to avoid facing a tax liability for revenue earned on unfinished projects that have yet to generate cash flow.

Previous Law

Under the previous law, unless your company fell under the “small contractor exemption” (average annual gross receipts for the three taxable years proceeding, not to exceed $30 million for 2024), the CCM was otherwise only permitted for construction projects where 80% or more of the estimated total contract costs were allocated to a home construction contract, specifically defined as a dwelling unit containing four or fewer units. The IRS definition of a “dwelling unit” does not include hotels, motels, or other living spaces that are used on a transient basis. The new bill expands the language to allow “residential” construction projects to be exempt from PCM, eliminating the ceiling of four units and giving construction professionals an easier tax planning approach to large-scale projects, such as apartment buildings and condo complexes.

Projects That are Exempt from PCM

A few examples of construction projects that could be exempt from PCM that previously were not are as follows:

- Senior living facilities

- Student housing

- Mixed-use buildings, if most of the cost is allocated towards residential construction

- High-rise apartments

Cash-Flow Advantages Comparison

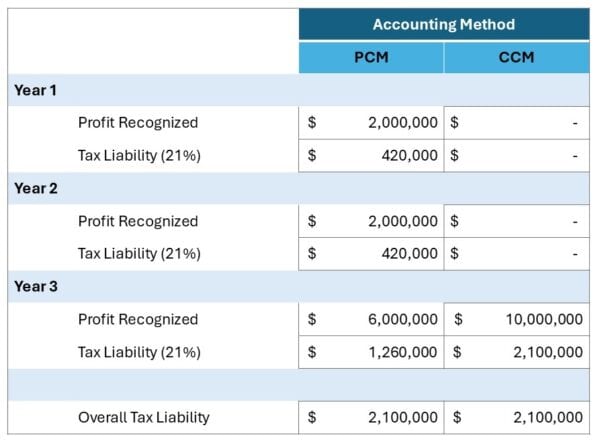

A simple example below shows the comparison of cash flows, in which the different methods result. This example compares a contract with $10 million of profit where, under PCM, 20% of profit is recognized in each of the first two years and 60% is recognized in the final year based on costs incurred throughout the project. Under CCM, the revenue is not recognized until the contract is complete.

As you can see, the CCM method allows cash-flow savings of over $800,000 for the first two years, compared to PCM. Another benefit is that using CCM makes your accounting department’s job easier by avoiding having to compute estimated total cost and recognizing revenue over time.

Conclusion

By expanding the PCM exemption for residential construction contracts, large-scale residential contractors can reap the benefits of simpler tax planning and more flexible cash flow in early construction phases, deferring the tax burden until project completion.

Written with contributions from Timothy Coleman, 2025 Summer Intern.