Many tax questions can be answered without leaving your home, waiting (and waiting) on hold with the IRS or calling your tax professional. The Internal Revenue Service official webpage, www.irs.gov, is your source to find answers to a myriad of questions. Here are some common questions that can be answered or tasks that be completed on the website.

1. Check the Status of your Refund (https://www.irs.gov/refunds)

There are two options to check the status of your refund on www.irs.gov. On the main page you can either click on “Refunds” on the toolbar, or click on “Get Your Refund Status” under “How can we help you?”

Once you get to the next page, you may click “Check My Refund Status,” but you may also read current IRS information about:

- What to expect in terms of timing for your refund for the current year.

- Why having your refund direct deposited from your tax return will be a more reliable, secure and faster way to get your refund moving forward.

- Most importantly, for the future “If you’re due a refund from your tax year 2021 return, you should wait to get it before filing Form 1040X to amend your original return.”

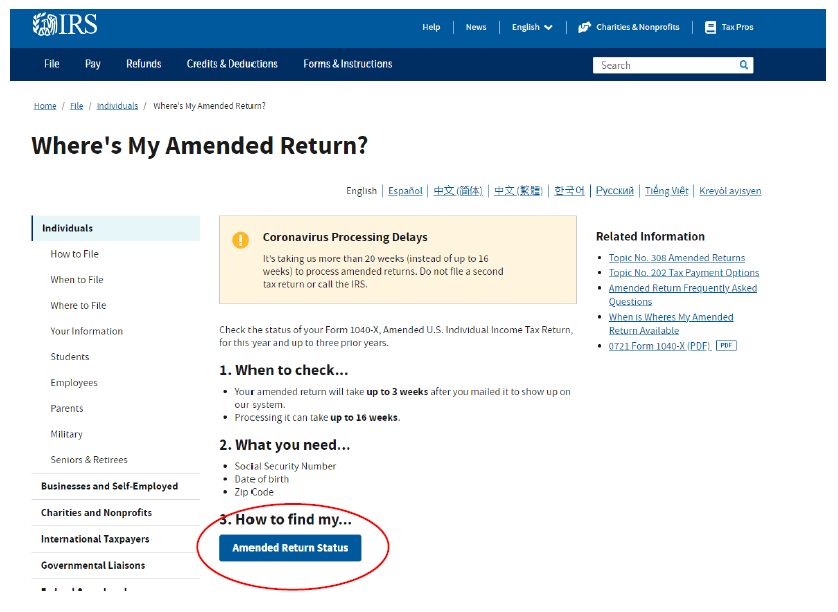

2. Check the Status of your Amended Return (https://www.irs.gov/filing/wheres-my-amended-return)

If you have filed an amended return in the past few years, you may also check the status of that on the IRS website. If you scroll down on the homepage for the IRS, there is a section called Tools & Applications. If you click on the arrows, eventually, you will see a “Where’s My Amended Return?” section with a link to “Check my amended return.” This will take you to this page where you can just click on “Amended Return Status” to see whether or not the IRS has processed your return.

3. Make a Federal Tax Payment (https://www.irs.gov/payments.)

You can either use your online account (see number 6 below) to make estimated or extension payments, or you can make these payments from the www.irs.gov homepage by clicking on “Make a Payment” or “Pay” at the toolbar on the top of the website. From here, you may set up a payment from either your bank account, debit card, credit card or a digital wallet. It also has a link to the Electronic Federal Tax Payment System (EFTPS) https://www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-system

Thompson Greenspon also has a dedicated page linked to not only the IRS payment page, but also the Virginia, Maryland, and District of Columbia payment pages for both individuals and businesses. You can find it here: https://www.tgccpa.com/payment-links/

4. Tax Withholding Estimator (https://www.irs.gov/payments/tax-withholding)

Also within the Tools & Applications section of the main IRS webpage is the link to the tax withholding estimator. The tax withholding estimator is a good tool to use to try to ensure you do not owe too much to the IRS while also not being stuck with a huge tax refund. Most taxpayers do not want a big tax bill to the IRS. Many consider receiving a large refund undesirable as well, as it is often considered an interest-free loan to the Federal government. A big income event, change of job, change in marital status, or birth or adoption of a child may all have an impact on tax liability. Taxpayers can recalculate their withholding a different points of the year and use this estimator to help fill out a new Form W-4 with an employer, anticipate a shortfall in withholdings or estimated payments, or preview a possible refund.

5. Information on Retirement Plans (https://www.irs.gov/retirement-plans)

Last but not least, you may use the IRS website to get started on the most important step in building wealth: saving for retirement. From the homepage, if you scroll over “Credits & Deductions” at the top of the main page, there is a dropdown and one of the links is “Retirement Plans.” Once on the next page, you may click into any information you would ever want to see about IRAs, any other types of retirement plans (including 401(k)s, 403(b)s, SIMPLE 401(k) plans, SEP, 457 plans, profit sharing plans, etc.). This webpage is a great resource to help find your answer to any questions you may have on these plans.

6. Set up your Individual Account (https://www.irs.gov/payments/your-online-account)

Setting up an online account on www.irs.gov can save you countless hours calling the IRS. With an online account, you can do the following with a couple of clicks of the mouse:

- Check on your tax transcript electronically

- Set up a Power of Attorney to allow your tax professional to represent you with the IRS (usually your tax preparer will initiate this with you, be sure to discuss with them first)

- Check notices from the IRS

- Make estimated payments, amended return payments, proposed tax assessment payments, or balance payments on your individual account associated with your 9 digit social security number.

- Opt-in/out of Advance Child Tax Credit with update portal

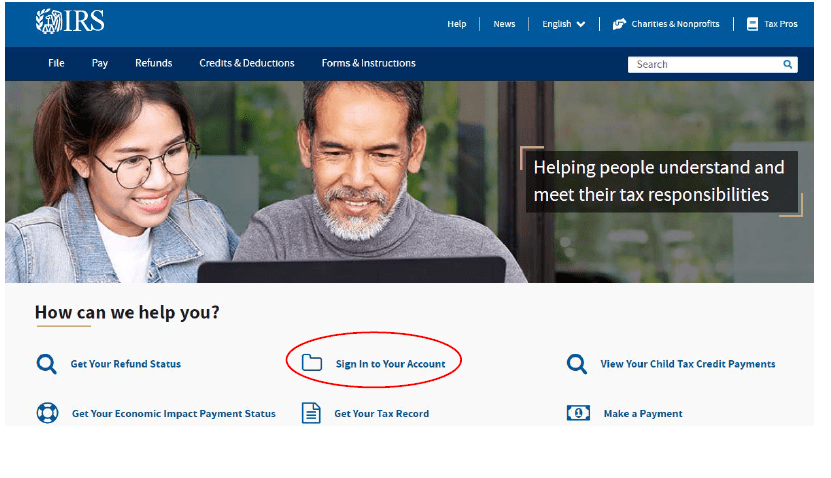

To set up an account, on the main home page, click on “Sign In to Your Account”:

Then click on the blue box “Sign in to your Online Account” and then click on the Create a new account box. You will have to enter your email address and create a password and prove to the IRS that you are who you claim to be through more stringent than normal security measures. But once you have the online account set up, you may do all of the above actions.

There are countless other great tools available on www.irs.gov. These are just a few helpful tools that may benefit an individual taxpayer or a small business owner.

Written by: Alex Tuvin, CPA – Supervisor

Alex Tuvin is a tax supervisor at Thompson Greenspon and joined the firm in 2014. In December 2019, Alex left his position with Thompson Greenspon due to moving out of the greater Washington, DC area but returned to the firm in December 2021. He works in the government contracting, professional services and construction & real estate industries. His experience includes the review of Federal and multi-state tax returns and assisting his clients with tax planning throughout the year at both the business and individual level to help them prepare for the future.