A pass-through entity is any entity in which the income and losses from operations pass through the entity level and down to the partners or members who are ultimately taxed on that income at Virginia’s individual tax rate of 5.75%. These pass-through entities include partnerships, S-Corporations, and single member LLCs. States have enacted legislation to allow partners and members of these entities to elect to pay state income tax at the entity level. These are normally referred to as pass through entity tax elections. The intention is to allow individuals to circumvent the $10,000 state and local income tax deduction cap forced on individuals by the Tax Cuts and Jobs Act of 2017. Virginia has established its own version of an elective pass-through entity tax under House Bill 1121, Chapter 690 and Senate Bill 692, Chapter 689 of the 2022 Acts of Assembly. This legislation was enacted for tax years 2021 through 2025.

How Does it Work?

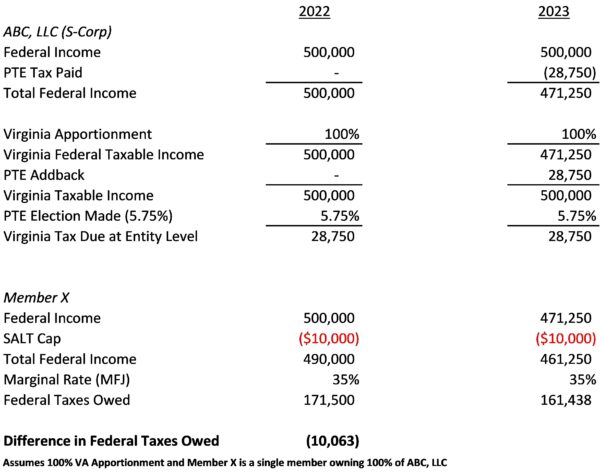

The Pass-Through Entity Tax election is made by a member of the pass-through entity. The rate of this tax is equivalent to the individual tax rate at 5.75%. Instead of reducing an individual’s income via itemized deductions, the deduction will come in the form of additional state tax expense at the entity level which will net with ordinary income (box 1) on the Federal K-1 or reduce Schedule C income. The benefit of the election could be delayed in the initial year depending on when the pass-through entity tax is elected and paid. See below for a simple scenario.

How to Elect the Virginia Pass-Through Entity Tax

Virginia was a bit late to the game when it comes to pass through entity taxes. While some appreciate the option, the issue now lies in the application of the election. Virginia will not be ready to implement this program until October 2023. Taxpayers were informed by the state not to attempt to make an election in 2021 nor attempt to pay the 5.75% pass-through entity tax with their 2021 tax returns. Such attempt would be rejected by the Department. The guidance issued by October 2023 will also include instruction for implementation for the 2022 through 2025 tax years. Please see Virginia Tax Bulletin 22-6 for additional information.

Additional Insight – Virginia Credit for State Taxes Paid

Virginia Public Document 21-156 contained a ruling by Commissioner Craig M. Burns to a request that Virginia allow, as a credit, the pass-through entity tax elected and paid for on a Maryland pass-through entity tax return. The ruling stated that a tax paid at the entity level is not attributable to its partners or members unless they are shareholders of an S-Corporation. Therefore, only members of an S-Corporation would be permitted to take such a credit. The new legislation enacted by the 2022 General Assembly overturned Mr. Burns’ ruling. The legislation states that taxpayers of all forms of pass-through entities may be able to claim a credit on their individual tax return for pass-through entity taxes under another state’s pass-through entity tax structure.

Conclusion

A pass-through entity tax election may be a great tool to help reduce your Federal burden. Keep in mind that electing pass-through entity taxes may not benefit all partners or members in a pass-through entity. Residency, apportionment, number of partners or members, and ownership percentage are all factors when considering this election. Once the election is made for a tax year, it cannot be revoked. If you would like more information on this election or have other state-related questions, please call us at 703-385-8888.

Written by Alex Scott, CPA: