Looking for 2020 Tax Filing Due Dates? Click Here for the newest list.

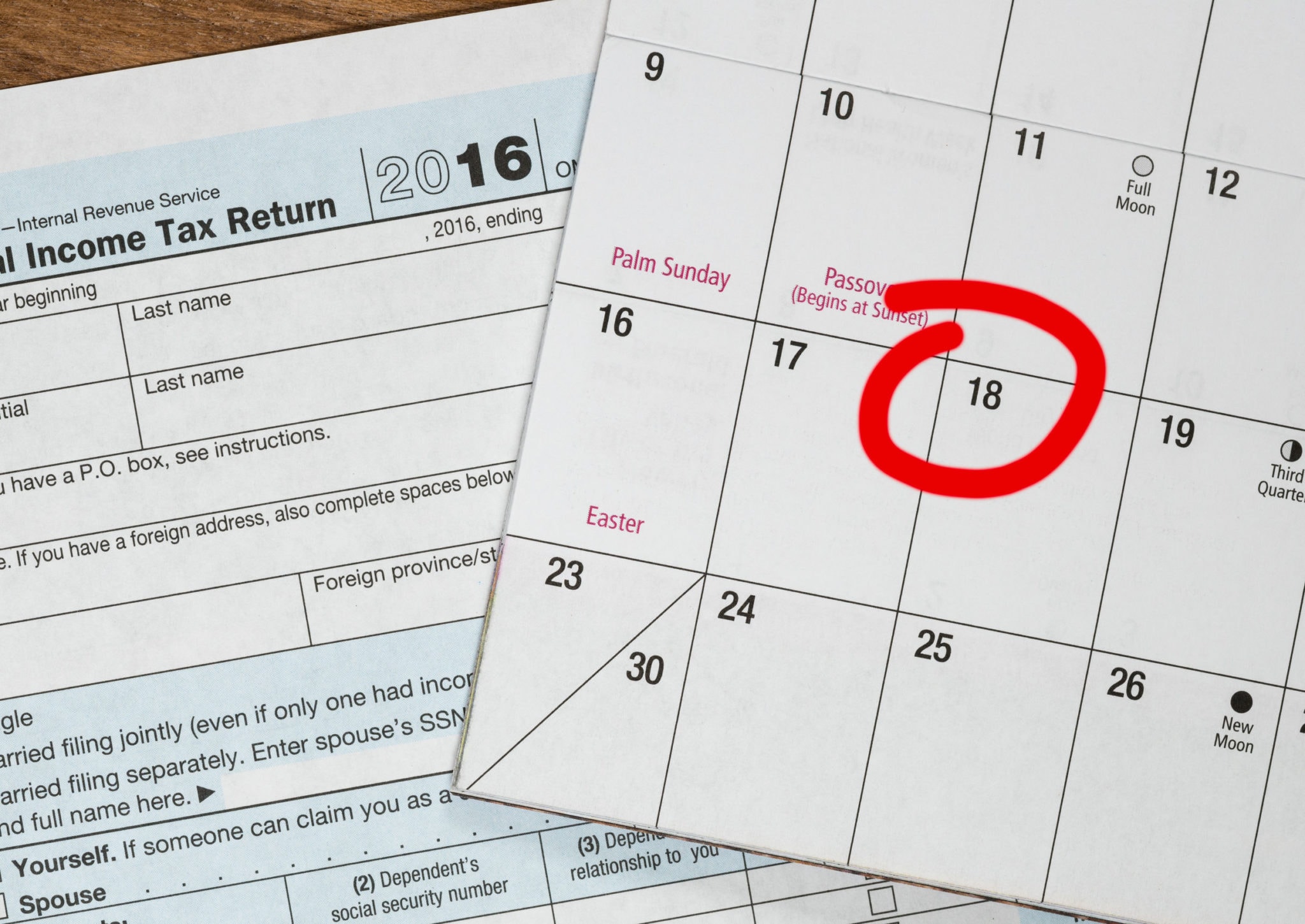

Tax returns to be filed in 2016 have new due dates that will impact nearly all filers, either because the due falls on the weekend and the observation of Emancipation Day in DC or because of changes related to legislation Congress passed at the end of 2015.

Several bills passed by Congress late in 2015 contained provisions that affect items that are not related to the main bill. The “Surface Transportation and Veteran’s Health Care Choice Improvement Act of 2015” is one such bill. Primarily passed as a stopgap extension of the Highway Trust Fund, this bill also included tax provisions that impact the due dates of a number of returns and other required filings.

The due date changes with the most impact will likely be those changes for Partnership tax returns (Form 1065) and C Corporation tax returns (Form 1120). Essentially the due dates have swapped, with Partnership returns due March 15th and C Corporation returns due April 18th. The significant reorganization of due dates is intended to assist individuals involved in pass-through entities in receiving information required to prepare their individual returns in a more timely fashion.

In addition to the swapping of partnership and corporate due dates, Forms W-2 are now due to the IRS on January 31st, regardless if they are filed electronically or by mail. Also new for tax year 2016 (reporting in 2017), the foreign bank reporting on FinCEN 114 (FBAR) is due on the same date as the individual tax return, Form 1040, and is eligible to be extended to the individual extended deadline, October 16th.

Whenever a regular tax filing date falls on a Saturday, Sunday, or a legal observed holiday in DC, the due date for returns is pushed to the next business day. In 2017, several due dates will be adjusted because of this rule: The Individual and FBAR due date and extension due date, the new C Corporation due date and the Form 1041 due date and extended due date.*

For tax returns reporting 2016 information that are due in 2017, the following dues date will apply. These changes are effective for tax years beginning after December 31, 2015 for calendar year filers (tax year 2016 and beyond):

Form |

2017 Filing Due Date (Tax Year 2016) |

| Form W-2 (electronic or mail)

Form 1065 – Partnerships Form 1120-S – S Corporations Form 1040 – Individuals FinCEN 114 – FBAR (will be allowed to extend) |

January 31st

March 15th March 15th April 18th April 18th |

| Form 1041 – Trusts and Estates

Form 1120 – C Corporations Form 5500 series – Employee Benefit Plan Individual and FBAR Extension |

April 18th

April 18th July 31st October 16th |

| Form 1065 Extension | September 15th |

| Form 1041 Extension | October 2nd |

| Form 5500 series – Employee Benefit Plan Extension | October 16th |

*Please note: Some of the above due dates are different from standard filing dates due to holidays or weekends.

For fiscal year filers:

- Partnership and S Corporation tax returns will be due the 15th day of the third month after the end of their tax year. The filing date for S Corporations is unchanged.

- C Corporation tax returns will be due the 15th day of the fourth month after the end of the tax year. A special rule to defer the due date change for C Corporations with fiscal years that end on June 30 defers the change until December 31, 2025 – a full ten years.

- Employee Benefit Plan tax returns are due the last day of the seventh month after the plan year ends.

It is important to check when tax returns are due for all states in which taxpayers operate, because individual states may not conform to the Federal filing dates. In addition, please keep in mind that the same holiday and weekend due date adjustments apply for Federal filing.

Changes include:

- Filers of U.S. Return of Partnership Income (Form 1065) will have a longer extension period, a maximum of six months, rather than the current five-month extension, leaving the former (2015 and prior years) extended due date in place (September 15th for calendar year taxpayers).

- U.S. Income Tax Return for Estates and Trusts (Form 1041) will have a maximum extension of five and a half months, two weeks longer than the former (2015 and prior years) five-month extension.

- Annual Return/Report of Employee Benefit Plans will have a maximum automatic extension of three and a half months.

- Report of Foreign Bank and Financial Accounts (FinCEN 114, FBAR) will be due on the same due date as the individual Form 1040 and permitted to extend for six months, thus aligning the FBAR reporting with the individual tax return reporting. Additionally, the IRS may waive the penalty for failure to file a timely extension request for any taxpayer required to file for the first time.

If you have any questions about these new due dates and the impact on your tax filings, please contact one of our qualified tax professionals at 703.385.8888 or info@tgccpa.com.

© 2016

Now that you’re caught up for 2017, check out the New Tax Due Dates for 2018!